Milaap creates sustainability by blending crowdfunding and micro lending

Target audience: Nonprofits, cause organizations, foundations, NGOs, social enterprises, educators, journalists, general public.

Icould begin this post by regurgitating any number of statistics on the sensory and information overload we all experience these days, but I won’t. We all know that that’s the world we live in. Technology has really broken down barriers to information and while that’s mostly a good thing, it can be really overwhelming as well.

Icould begin this post by regurgitating any number of statistics on the sensory and information overload we all experience these days, but I won’t. We all know that that’s the world we live in. Technology has really broken down barriers to information and while that’s mostly a good thing, it can be really overwhelming as well.

As a result, breaking through the digital clutter these days is tough. So what do you do when your cause depends on you doing just that? How do you make sustainable giving a reality, so that both your cause and supporters benefit?

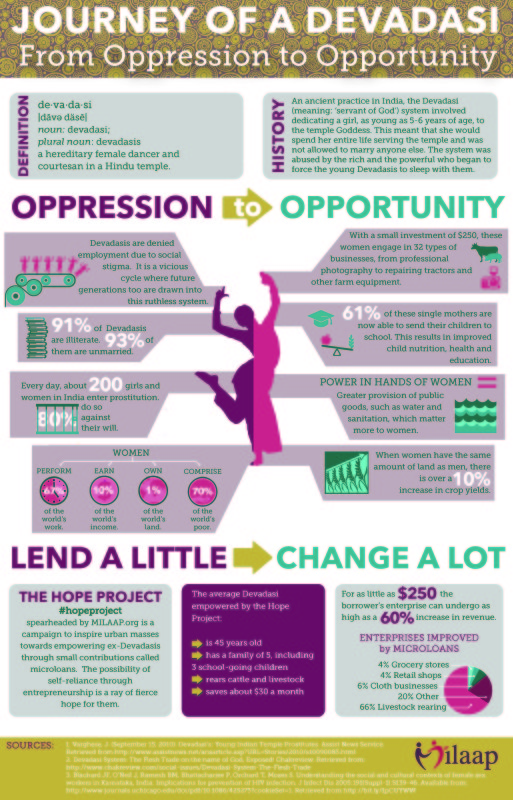

Milaap (disclosure: my client) is a unique online platform that blends crowdfunding with micro lending, giving people from around the world the ability to both lend and/or create personal fundraisers for India’s working poor. These micro loans – which start as low as $25 and are repaid in full at the end of the loan term – fund projects in fields as diverse as energy, water, and education. To date, Milaap has a 98% repayment rate, which is quite remarkable.

Here are three ways Milaap is socializing and changing the face of giving:

- Anyone who gives through Milaap can set up a fundraiser for a project they are touched by. But here’s where it gets interesting; you can make these fundraisers social. In other words, you can bring your community in, asking them to join you in lending to this specific project, telling them why. So, all of a sudden, you don’t just have one person fundraising, you have 3, or 6, or 19… the possibilities are endless! Takeaway: Many hands do make light work. When you encourage people to involve their communities, you grow your own at the same time. This is what has enabled Milaap, over the last four years, to raise $1.6 million, give out almost 13,000 loans and take close to 50,000 people from oppression to opportunity.

- What I really like about giving through Milaap is that the money you give is a loan—not a donation. While this in no way negates making donations to nonprofits, I think it’s a really smart approach. With the immense donor fatigue we all experience, it’s refreshing to know you will get your money back once the loan matures (unless you choose to relend it, of course, which many people do). As a small business owner myself, I love that approach, as there is accountability built into the process. Takeaway: Elevate your supporters’ investment of time and energy in your cause. Showing them the end-recipients are equally invested is a great way to do so.

- The best way to touch someone’s heart is by telling them a story. And Milaap has great stories to tell—of its borrowers, of its supporters, of its employees and partners. It has a really rich content bank, especially of visual assets. But what it does very well is let its borrowers stories speak for themselves. I defy anyone to not be moved by the video above we put together for its flagship campaign in 2014, the #HopeProject. Takeaway: Stories work best when they come straight from the source. As much as possible, let those in your stories tell them.

Today is Milaap’s fourth birthday. To celebrate, it is hosting a round-the-clock, global online conversation on sustainable giving, and I do hope you’ll join. Here’s more on today’s #Milaap4Hope event (it’s very easy to join, just log onto the respective platform based on which event catches your fancy, and follow/use that hashtag).

If we all do our part, we can change the face of giving.Shonali Burke is a public relations and social media expert and consultant based in Washington, D.C. Her firm provides integrated PR for measurable results. You can connect with Shonali via her website or follow her on Twitter.

This work is licensed under a Creative Commons Attribution 3.0 Unported.

This work is licensed under a Creative Commons Attribution 3.0 Unported.